The share of UK drivers expecting their next car to be all-electric at the end of last year fell compared to 12 months earlier, according to a revised report published by the country’s Department for Transport (DfT). But 2024 thus far, in new registrations at least, has singularly failed to match the pattern suggested by the responses. Why?

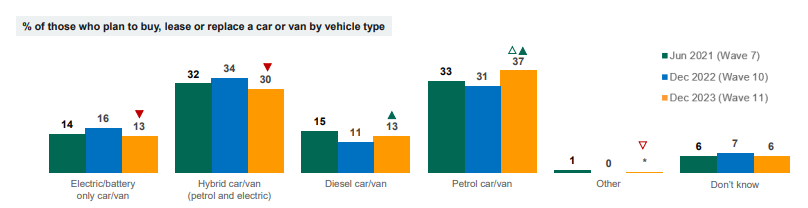

Just 13pc of those planning on changing their car or van — in either the new or second-hand market — expected to choose a BEV next, the DfT’s Technology Tracker report, compiled by polling company Ipsos, found. That compared with to 16pc in the same report in December 2022.

If accurate, this could have been concerning news for the UK government, as its zero emissions vehicles (ZEV) Mandate currently calls for 22pc of new cars and 10pc of new vans sold the year to be ZEV, in reality all-electric — rising sharply to 80pc and 70pc respectively by 2030. With the UK’s relatively new government seemingly committed to shifting the country’s ICE sales ban forward again from 2035 to 2030, these targets could even potentially get revised to an even more precipitous upward slope.

But it should also attract the attention of OEMs. They need to persuade the public to buy more BEVs or face fines under the mandate — from which the current administration is unlikely to be able to back away even if it was minded to do so, given the risk of alienating the significant proportion of its core vote that lean towards environmentalism.

The share of those intending to buy either an HEV and PHEV next also declined in the survey, falling from 34pc to 30pc (see Fig.1). In contrast, buying intentions for gasoline vehicles rose from 31pc to 37pc, while diesel also saw a rise from 11pc to 13pc.

Reality check

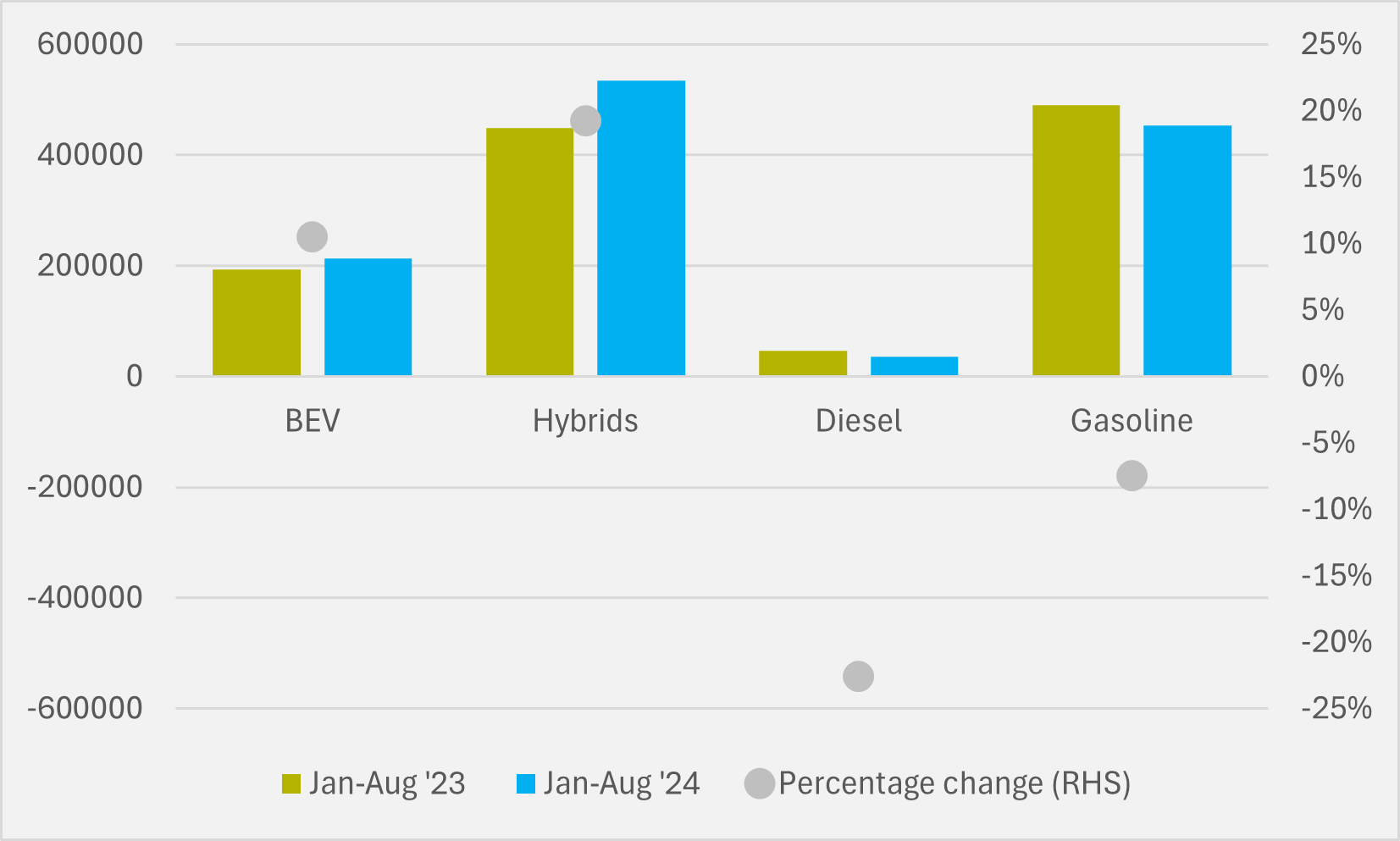

But the striking thing about the data is how divorced it has proven from buying trends in the new car market seen in the UK since the start of the year. In the first eight months of this year, new UK BEV registrations have increased by 10.5pc and hybrids by 19.2pc, while gasoline purchases have fallen by 7.5pc and diesel by 22.6pc (see Fig.2).

Market shares see a similar disconnect. The share of all-electric vehicles in new sales has risen year-on-year in Jan-Aug from 16.4pc to 17.2pc, well above the 13pc findings in the survey. Similarly, hybrid registrations have expanded from 38.1pc to 43.2pc, far ahead of the 30pc share the survey results indicated.

Conversely, gasoline and, particularly, diesel buying intentions have proven overstated. Petrol vehicles’ slice on the pie so far this year has fallen from 41.6pc to 36.6pc, although that is still close to the survey result.

But diesel sales have dropped from 4pc share of the UK mix to just 2.9pc, nowhere near the 13pc of people Ipsos found were expecting to go diesel with their next purchase. Only just over 35,000 new diesel vehicles have been registered in the UK in the first eight months of the year — compared to over 210,000 BEVs, 450,000+ gasoline vehicles and c.535,000 hybrids. Far from seeing a renaissance in interest, diesel as a personal mobility fuel in the UK is dying a relatively quick death.

Apples and oranges

It is worth stressing that the Jan-Aug data is for new vehicles sales, while the Ipsos survey covers both new and second-hand markets. Just by the nature of the existing UK car parque, a greater percentage of the second-hand sales will be ICE compared to electrified vehicles than in the new market.

But any genuine loss of buyer faith in BEVs and hybrids would likely show up in new sales, not be contradicted by them. There is also strong anecdotal evidence that, owing to tumbling residual values, interest in second-hand BEVs is actually going up.

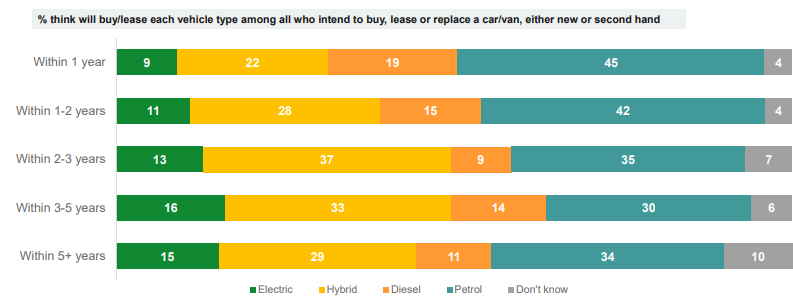

It should also be pointed out that the DfT report covers anyone thinking of changing their vehicle in the next five or more years, not simply in the next year, so again not an entirely analogous comparison. But for those expecting to buy within a year, the differences are even starker: just 9pc expected to go BEV, 22pc a hybrid, 19pc a diesel, and 45pc petrol (see Fig.3).

Getting informed

One factor that could be behind the disconnect is a simple information gap. Before a customer has done their research, they might expect to stick with their current gasoline or diesel fuel option, only to find, when they start their car or van search, that the hybrid or all-electric choices are more attractive than they thought.

Misinformation may also be playing a role in this. Last year was a particular vicious one in terms of British media carrying EV falsehoods, perhaps as vested fossil fuel interests saw a closing window to try to influence a dead duck right-wing administration that was all but guaranteed to lose power in 2024.

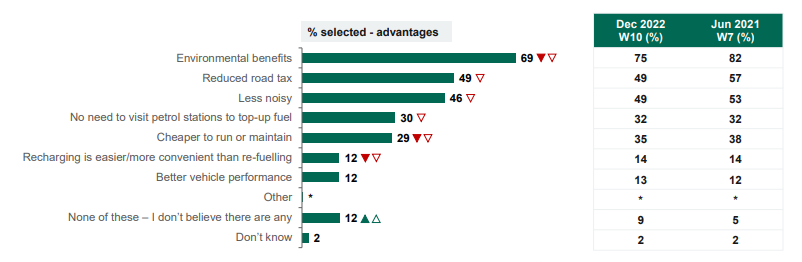

The report notes “decreases in almost all selected advantages” of BEVs over ICE vehicles offered to respondents (see Fig.4). Perception that BEVs offer environmental benefits, while still identified most often as an advantage for all-electric, fell to just 69pc, down from 75pc in December 2022 and 82pc in June 2021.

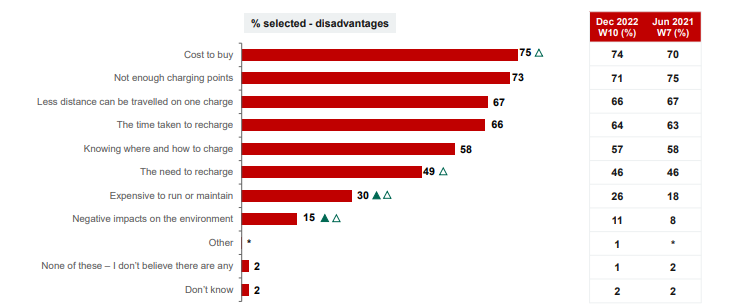

In parallel, there was an increase in the selection of negative impacts on the environment as a potential BEV disadvantage, In December 2023, the figure stood at 15pc, compared to 11pc in December 2022 and just 8pc in June 2021.

Being cheaper to run or maintain was identified as an advantage by 29pc of respondents in December 2023, lower compared to both December 2022 (35pc) and June 2021 (38pc). Again, a higher proportion (30pc) of respondents selected expensive to run or maintain as a potential disadvantage of BEVs in December 2023 than in December 2022, when it was 26pc and June 2021, 18pc.

Raising question marks about both EVs’ environmental friendliness and their cost benefits have been key planks of the anti-EV lobby’s fear, uncertainty and doubt (Fud) campaigns. And the proportion of respondents who said they did not believe there are any advantages to BEV also continued to increase, reaching 12pc in December 2023, more than double the 5pc of June 2021.

This year has, with a few notable exceptions among UK newspapers, seen a material dialling down of the anti-EV incentive, which may be influencing consumers towards more openness to electrified and electric options than they felt at the end of last year. But, again, it might simply be that, when they come to have the buying conversations, some of these myths are now being debunked at dealer level.

All about the money

But potentially a more potent driver is price. The survey found that those in the highest income households, earning over £100,000 ($134,000), were “significantly more likely” than all other household income groups to expect to purchase or lease an electric car or van next, suggesting that BEVs are still seen more as a luxury option for premium buyers.

Almost a quarter (24pc) of £100,090+ households said that they were likely to go all-electric, compared to 11pc of those in households earning up to £25,999, 10pc in households earning up to £51,999 and 17pc of households earning between £52,000-£99,999.

EV inFocus – Google News

Read full articles from EV inFocus and explore endless topics, magazines and more on your phone or tablet with Google News.

There was also geographical difference, with residents in London — on average more affluent than the UK as a whole and also boasting the most developed public charging network — being more likely than those in other regions to say they were most likely to purchase or lease a BEV next. Compared to 13pc of those in the north of England and 11pc of those in England’s Midlands region, 21pc of London buyers planned to do so.

And cost to buy remained the most selected potential disadvantage of BEVs, chosen by 75pc in December 2023, in line with December 2022 but a higher proportion than the 70pc recorded in June 2021 (see Fig.5). So, at the end of last year, the perceived cost of BEVs remained a significant stumbling block.

This year, though, has seen two trends: discounting of both BEVs and hybrids as legacy OEMs aim to get closer to their ZEV Mandate targets and a trickle of long-promised more affordable all-electric models beginning to hit the market.

In other words, make BEVs more affordable and more people who might not have been expecting to go all-electric yet will buy them. A lesson for all OEMs grumbling about government targets, lack of taxpayer money-funded incentives and underwhelming consumer appetite perhaps.