Key Takeaways

- Black Friday is fast approaching, which makes it the perfect time to review financing options.

- If you’re an Apple Pay user, you have a number of split payment options to choose from.

- Apple Pay works across all the company’s consumer product lines, making it a great choice if you’re already within the Apple ecosystem.

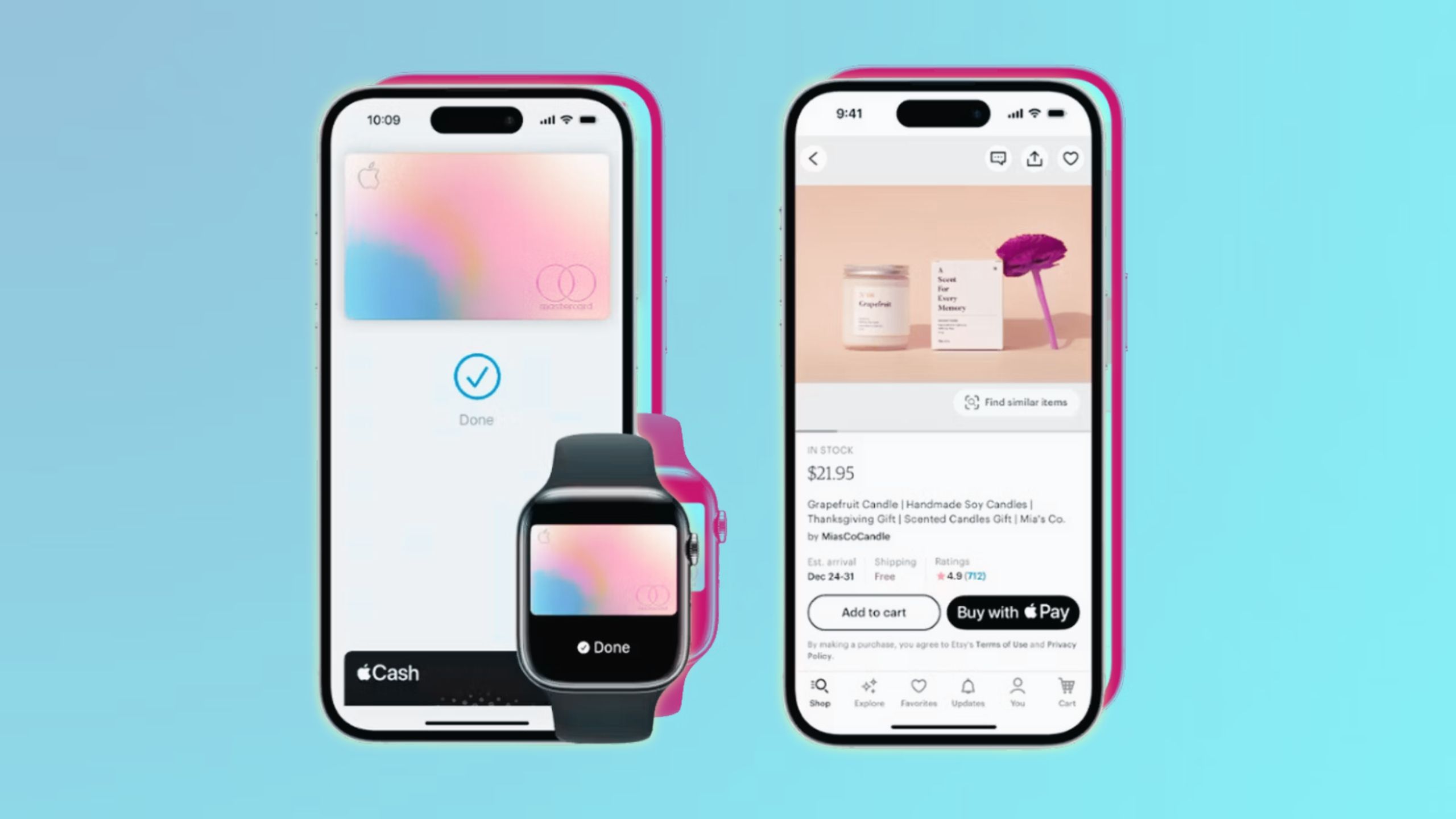

With another year of Black Friday sales rapidly approaching, there’s no better time than now to take stock of all your financing options. If you’re a user of Apple Pay — the default payment system across the Apple Watch, iPhone, iPad, and Mac — then you have a wealth of options at your disposal.

Apple previously offered its own in-house Apple Pay Later feture, but shuttered the service earlier this year. Thankfully, third-party options have picked up the mantle — here’s the lowdown on how to make use of the Klarna and Affirm financing tools, all while remaining within the sphere of Apple Pay.

Related

How to set up and use Apple Pay across your devices

Apple Pay makes purchases more convenient with just a tap of your iPhone or Apple Watch. You can also checkout online without digging out your wallet.

How to set up split payments via Klarna using Apple Pay

The process only requires a few simple steps

Klarna

Klarna

An online shopping and payments app that allows you to shop now and pay later, with Apple Pay integration.

To leverage Klarna’s split payment option within Apple Pay, follow these steps:

- Download the Klarna appfrom the App Store and sign in using your account credentials.

- At the checkout screen of whichever product you’re purchasing, choose Apple Pay from the list of payment options.

- Tap on Select Other Cards & Pay Later Options.

- Select Klarna from the list.

- Use your iPhone’s FaceID or TouchID biometric sensors to authenticate your purchase.

According to the Klarna support page, this financing capability is limited to iPhones and iPads running iOS 18 and iPadOS 18 or later, respectively. Regional availability also varies — for the time being, Apple Pay’s Klarna integration is exclusively available in the US, in the UK, and in Canada.

Related

Apple Pay gets new flexible payment integration and announces big upgrade coming in 2025

Apple has announced PayPal is coming to Apple Pay next year. New payment plan options are also available now.

How to set up split payments via Affirm using Apple Pay

The process of using Affirm is not unlike that of Klarna

Affirm

Affirm

An online shopping and financing app that allows you to make split payments on purchases, with Apple Pay integration.

To get started with Affirm’s split payment option within Apple Pay, follow these steps:

- Download the Affirm appfrom the App Store and sign in using your account credentials.

- At the checkout screen of whichever product you’re purchasing, choose Apple Pay from the list of payment options.

- Tap on Select Other Cards & Pay Later Options.

- Select Affirm from the list.

- Use your iPhone’s FaceID or TouchID biometric sensors to authenticate your purchase.

As is the case with Klarna, Apple Pay’s Affirm integration is limited to Apple devices running iOS 18 and iPadOS 18 and later. Affirm via Apple Pay is currently available within the US and Canadian markets.

In order to take advantage of either Klarna or Affirm and their financing benefits, you’ll need to be registered and set up with Apple Pay.

Pocket-lint has a dedicated article

with steps on how to complete the Apple Pay setup process.

Once everything is set up, you’ll find that these financing apps offer a variety of split payment options — the precise details will depend on the price of whichever product you’re purchasing. Klarna offers a popular 4 interest-free payment option, for example, and Affirm has comperable options available.

Related

Bye now, pay later: Apple Pay Later is shutting down

Apple Pay Later is leaving us already, but an alternative is in the pipeline.