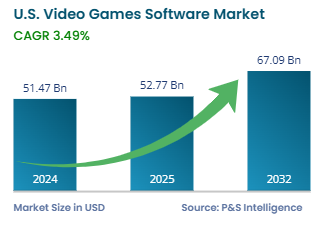

U.S. Video Games Software Market Revenue Insights

Market Statistics

| Study Period | 2019 – 2032 |

| 2024 Market Size | USD 51.47 Billion |

| 2025 Market Size | USD 52.77 Billion |

| 2032 Forecast | USD 67.09 Billion |

| Growth Rate (CAGR) | 3.49% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

| Largest End User Category | Personal |

Growth Forecast

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

U.S. Video Games Software Market Future Outlook

The U.S. video games software market size was USD 51.47 billion in 2024, and it will grow by 3.49% during 2025–2032, reaching USD 67.09 billion by 2032.

The market is growing due to the craze for online gaming platforms, the recent developments in technology and connectivity, need to make leisure time more fun, growing adoption of smartphones and tablets, the availability of freemium games, and enhancements in graphics and haptic controls. Many companies in this industry are heavily investing in advancing their technology to gain a competitive advantage.

Another key driver for this growth is the shift to digital distribution, which has made it easier for consumers to download games and play them online. The mobile gaming segment is another major contributor due to smartphones becoming the primary gaming device for the majority of users. Further, augmented reality and virtual reality and advancements in AI offer new opportunities to the industry.

U.S. Video Games Software Market Emerging Trends & Growth Drivers

Digital Gaming, Subscription Models, and Cloud-Based Deployment Are Key Trends

The trend of online games continues to grow since more customers choose to download games instead of buying physical CDs, because digital access offers convenience. Xbox Cloud Gaming is a popular cloud gaming solution that allows players to stream games without having to purchase costly gaming devices.

The subscription-based gaming models offered by Xbox Game Pass and PlayStation Plus provide unlimited game libraries to players for monthly payments. Mobile gaming continues to gain takers because smartphones now serve as the primary gaming platforms for millions of people, delivering memorable gaming experiences without bulky hardware.

Today’s virtual reality and augmented reality technology enhancements provide players with immersive gameplay experiences that push beyond traditional boundaries. Similarly, AI-based programming tools enhance experiences by delivering dynamic player response control, alongside real-time environment generation and sustained audience engagement in updated systems.

Both Xbox Game Pass and PlayStation Plus provide affordable game subscriptions for many games at a time. As indie games and online platforms, such as Roblox, become more popular, they expand the market diversity and allow small developers to gain worldwide audiences for their new creative ideas.

Cloud gaming enables all gamers to play premium games without needing costly equipment, such as PCs or gaming consoles. Users now maintain uninterrupted game interactions during all their daily hours which confirms gaming serves as more than individual activity yet functions as modern-day social media.

Digital Leisure Boom Is Major Growth Driver for Market

Gaming has transformed into a necessity, becoming a core part of how people relax, connect, and escape the pressures of modern life. As per a recent study, almost 61% of the Americans in the age group of 5 to 90, which amounts to 190.6 million people, play video games for at least 1 hour each week. People turn to gaming as a relaxation method because of work–life stress and social pressure, along with urban burnout. COVID-19 caused an explosive growth in gaming as it became a regular part of life, beyond being a casual lockdown pastime. As per studies, leisure and sports are the second-most-popular way of spending time for people in the U.S., after sleeping. Businesses engaged in significant investments to build up their online gaming networks that enhanced their connectivity along with interaction capabilities. The release of 2 million new games and apps through publishers became a major mobile gaming success formula during the pandemic. Many games have created interactive digital spaces particularly for Gen Z and millennials.

Segmentation Analysis

Device Analysis

- The console category held the largest market share, of 45% in 2024.

- People in the country favor console gaming because of its vast ecosystem for premium gameplay, its original content, and the high disposable income of most players. The gaming console divisions of Sony (PlayStation), Microsoft (Xbox), and Nintendo (Switch) maintain a dedicated followership, which shows strong support.

- The smartphone category will grow at the highest CAGR, of 4.56%, during the forecast period.

- As per a study, smartphones are used by over 90% of the country’s population, compared to merely 35% in 2011.

- The presence of games such as Fortnite and Call of Duty: Mobile and platforms such as Roblox drive the video game market with their free-to-play options, microtransactions, as well as multiplayer features.

The devices analyzed here are:

- Smartphone (Fastest-Growing Category)

- Console (Largest Category)

- PC

- Others

Genre Analysis

- The action category held the largest market share, of 30%, in 2024.

- This is because of their dynamic gameplay, which provides instant excitement to players as well as spectators.

- The market in this category is dominated by major franchises, including Call of Duty, along with Grand Theft Auto and Fortnite.

- The popularity of action games also remains high due to their online multiplayer features. The combination of regular content updates, battle passes, and in-game purchases makes these games earn top financial returns.

- The role-playing category will grow at the highest CAGR, of 5.35%, during the forecast period.

- These games allow people to escape the real world into a new one, express themselves in ways they find difficult in real life, gain new experiences and skills, sharpen their minds, and further their social development.

- The growing popularity of the metaverse, which is virtually a different world, also drives the uptake of role-playing games.

The genres analyzed here are:

- Action (Largest Category)

- Adventure

- Role-Playing (Fastest-Growing Category)

- Simulation

- Strategy

- Sports

- Others

End User Analysis:

- The personal category held the larger market share, of 70%, in 2024.

- This is because millions of individual gamers use personal devices to play video games, and they drive substantial player involvement.

- The commercial category will grow at the higher CAGR, of 4.85%, during the forecast period.

- This is because organizations are deploying games as training platforms for their personnel.

- Similarly, games can boost healthcare recoveries by rewarding users for compliance with their doctor’s advice.

- Games, especially those that simulate war-like situations, are used in military readiness exercises.

- Government agencies use gaming technologies for disaster management simulations, while the media & entertainment sector uses them for content creation, virtual events, and streaming platforms.

The end users analyzed here are:

- Personal (Larger Category)

- Commercial (Faster-Growing Category)

- Education

- Healthcare

- Aerospace & defense

- Government

- Retail

- Media & entertainment

- Others

Deployment Mode Analysis:

- The online category held the larger market share, of 80%, in 2024, and it will grow at the higher CAGR, of 5.67%, during the forecast period.

- Online games remove the requirement to buy special gaming PCs and consoles, which saves gamers a lot of money.

- Free-to-play online games make money through microtransactions and in-game purchases, resulting in growth in gaming companies’ revenue.

- Game streaming platforms, such as Twitch and YouTube Gaming, maintain extremely high levels of active user participation.

The deployment modes analyzed here are:

- Online (Larger and Faster-Growing Category)

- Offline

Drive strategic growth with comprehensive market analysis

Regional Outlook

- The western region of the U.S. held the largest market share, of 35%, in 2024.

- The gaming industry receives significant support from Washington state, where Microsoft Xbox and Valve operate. The video gaming community in this region includes significant numbers of influencers, streamers, and YouTube content creators.

- High venture capital funding supports gaming startups and emerging technology development in the western parts of the region.

- The southern region will grow at the highest CAGR, of 6.22%, during the forecast period.

- This is because the state of Texas now stands as a significant video game development center, with Retro Studios and id Software owning their R&D facilities and offices in the cities of Austin and Dallas.

- Numerous gaming companies are relocating their operations from California to other locations.

- The video game companies Electronic Arts and Blizzard have chosen Austin for their business expansion.

- Moreover, the key reason that drives the market in the region is its population, which is the highest across the U.S.

The regions analyzed in this report are:

- Northeast

- Midwest

- West (Largest Category)

- South (Fastest-Growing Category)

U.S. Video Games Software Market Share Analysis

The U.S. video games software market is fragmented in nature because of a high number of competitors and new entrants. There is intense competition between the companies due to new innovations and focus on growth strategies.

Microsoft holds a significant market share in the U.S. video games software market, attributed to its Xbox gaming platform, as do Sony Interactive Entertainment Inc. and Nintendo Co. Ltd.

Subscription services, such as Xbox Game Pass and PlayStation Plus, are expanding, which transitions the game industry toward membership fee structures from single-game purchases. Further, the rapid growth of mobile gaming leads to a change in market share distribution.

Video Gaming Software Developing Companies in U.S.:

- Microsoft Corporation

- Apple Inc.

- Sony Interactive Entertainment Inc.

- Nintendo Co. Ltd.

- Electronic Arts Inc.

- Take-Two Interactive Software Inc.

- Ubisoft Entertainment SA

- Activision Blizzard Inc.

- Epic Games Inc.

- Square Enix Holdings Co. Ltd.

- Valve Corporation

- Roblox Corporation