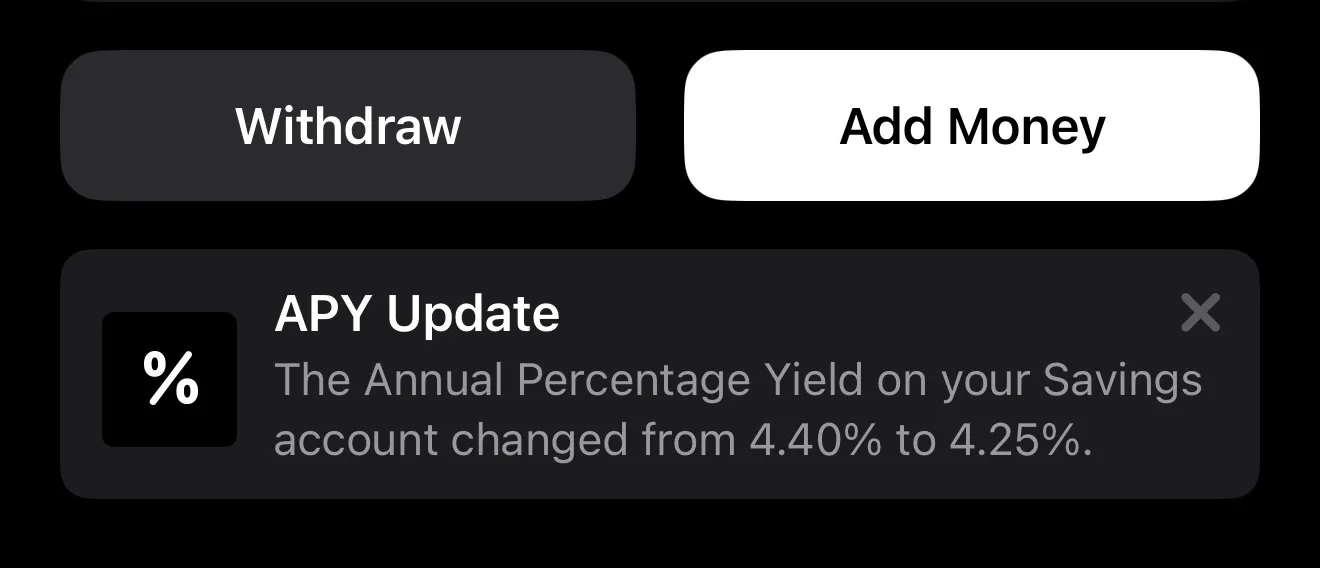

The annual percentage yield, or APY of Apple Card Savings account, was 4.15 percent when the service rolled out for users, with the company slowly introducing increments, allowing depositors to receive monetary rewards for their funds. That APY figure has witnessed a rise to as high as 4.5 percent, but the latest update mentions that the interest rate has been reduced to 4.25 percent, and there could be various reasons for this change. Regardless, it is still higher than the interest rate at which Apple Cards Savings was introduced at, putting users at an advantage.

The U.S. Federal Reserve recently approved an aggressive rate cut, which may explain why Apple Card Savings’ interest rate was reduced too

The change in the APY was reported by 9to5Mac, who reports that push notifications were sent to Apple Card users on a Tuesday evening. The last time the interest rate touched 4.25 percent was in December last year and it slowly crept up to 4.35 percent, then going as high as 4.5 percent in late January. Unfortunately, depositors had to endure a minor setback as the Apple Card Savings account interest rate was cut down to 4.4 percent, and now it has settled to 4.25 percent.

No exact explanation has been provided as to why the interest rate was reduced, but the report states that the U.S. Federal Reserve approved an aggressive rate cut last week, lowering rates by 50 basis points. Additionally, Apple’s and Goldman Sachs’ tumultuous business relationship is no secret, and there are whispers that the banking institution is desperately trying to get out of the deal because of the millions in losses that it has incurred.

Apple is trying to secure a partnership with another firm, with a previous report stating that JPMorgan Chase could fill the position, but there could be certain conditions involved. For instance, JPMorgan Chase wishes to pay less than the $17 billion Apple Card customers’ outstanding balance, mainly because these users have a lower credit score than other individuals, which increases the risk of doing business. The plus side is that even with the lower APY, the maximum deposit has been increased from $250,000 to $1,000,000.