c/o Counterpoint

It’s got to be a little bittersweet for Apple management, as no sooner has it finally become the world’s number one smartphone manufacturer for the very first time than it also learns its smartphoe business is going to continue to be battered by political correctness for some time to come as the on/off tariff regime pushes all the biggest global businesses around.

Up the hill and down again

The good news tempers the recent warning that, following an unexpected reprieve, US smartphone taxes will be imposed again in a month or two, meaning US shoppers can expect to pay more for the same thing while being told it’s good for them.

What is that good news?

It’s that the smartphone market grew in Q1, and Apple took position right at the top of the smartphone heap, in part on strength of the iPhone 16e launch. That’s according to Counterpoint.

Let’s review the stats:

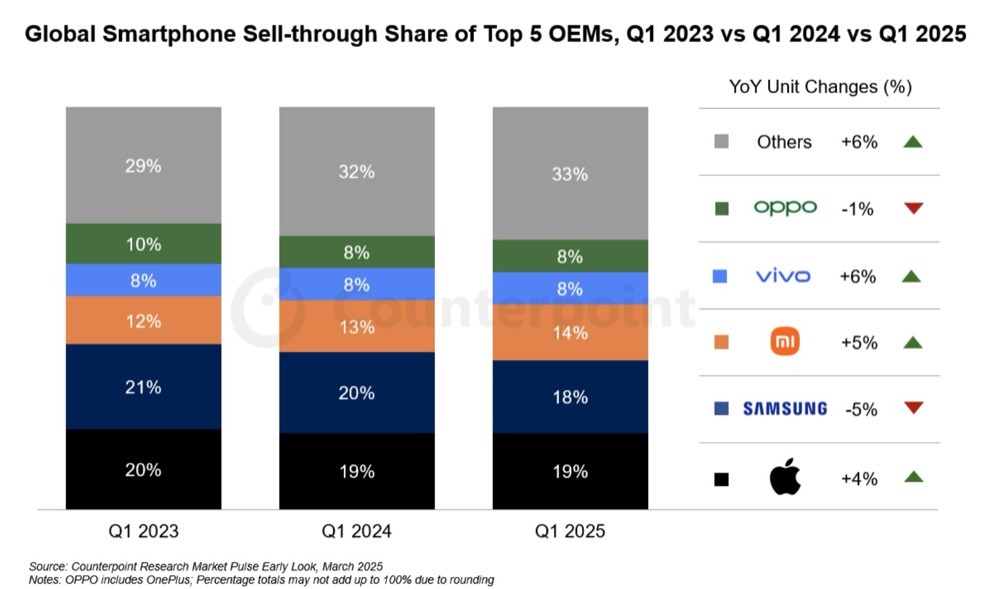

- Smartphone sales jumped 3% in Q1 on the year ago quarter.

- Apple took 19% share.

- Apple’s sales grew 4%, higher than the average

As the old markets fade, Apple saw growth in India and Japan, while industry growth was also in emerging markets and China.“While sales in the US, Europe and China were either flat or declining, Apple recorded double-digit growth in Japan, India, Middle East and Africa, and Southeast Asia.”

All the way to the bottom of the top

The tariff impact is coming, however. The analysts now think smartphone demand will decline across the rest of the year:

“After a decline in the market in 2023, it has shown steady growth led by improvement in macroeconomic conditions. Smartphones being an essential product will always have a steady sales graph, but economic uncertainties can make consumers postpone their purchases and thus, the rise in trade risks and unsettling of the supply chain can negatively impact on the market going forward. The proliferation of new technologies like GenAIand foldables will continue, but OEMs need to carefully monitor demand going forward. While our long-term outlook remains steady, we believe the market will show a decline in 2025.”

You can follow me on social media! Join me on BlueSky, LinkedIn, and Mastodon.