MOTORISTS have been warned about scammers sending out text messages over fake parking charges.

The Driver and Vehicle Standards Agency (DVSA) has issued the warning regarding dodgy penalty charges supposedly coming from the government body.

The text messages being sent out warn people they have got a “parking penalty charge” and if they do not pay the fee on time, they could be banned from driving, incur further fees or be taken to court.

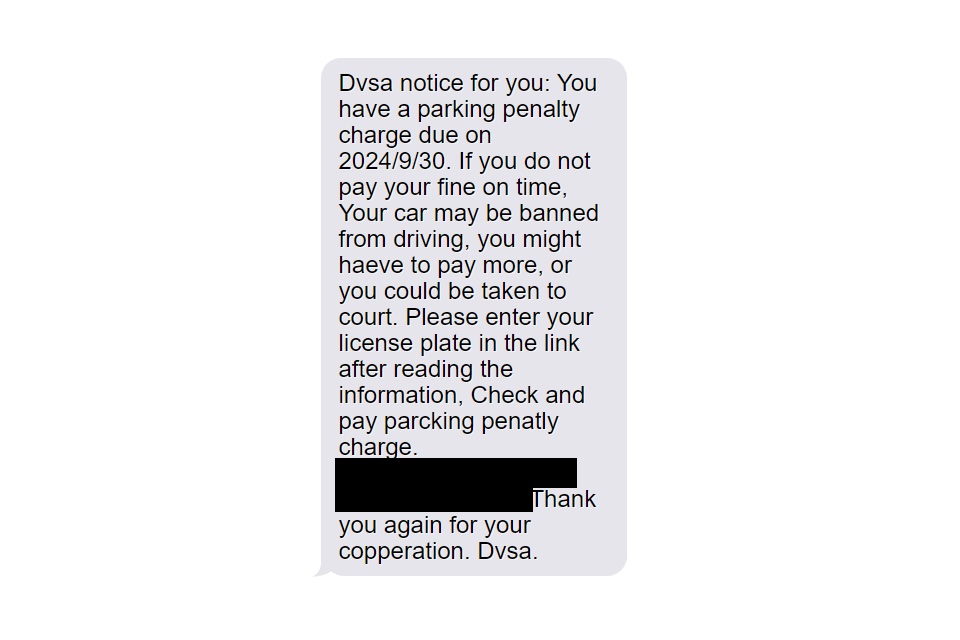

The text message, complete with spelling mistakes, says: “Dvsa notice for you: You have a parking penalty charge due on 2024/9/30.

“If you do not pay your fine on time, Your car may be banned from driving, you might haeve to pay more, or you could be taken to court.

“Please enter your license plate in the link after reading the information, Check and pay parcking penatly charge. Thank you again for your copperation. Dvsa.”

The DVSA does not issue or deal with parking fines.

If you do receive a message you can report it to the National Cyber Security Centre or click on the link here.

You do not have to contact the DVSA if you get the message.

If you have been tricked into sharing personal information with a scammer there are measures you can immediately take to protect yourself.

Scams are getting increasingly sophisticated, but there are a number of red flags to keep an eye out for if you’re being asked to transfer money.

If you receive a text or email asking for personal details, you can check if it’s real by calling whoever it claims to be from.

Your bank, for instance, will instantly confirm if it’s fraud and will advise you on what to do.

Any bank, trusted organisation or public bodies like councils or the police would will never ask you to withdraw, transfer or send back money from your account.

If you think you have been a victim of a scam, you should report it as soon as possible.

There is no guarantee you’ll get your money back, but banks will often compensate you if you can show you did not know the money would leave your account.

You can forward scam emails to report@phishing.gov.uk and should also contact your bank and report it to Action Fraud, which will give you a crime reference number.

Check if your bank is signed up to the voluntary APP code, which indicates it has pledged to reimburse customers who have been tricked into sending money to scammers.

How to protect yourself from fraud

USE the following tips to protect yourself from fraudsters.

- Keep your social media accounts private – Think twice before you your share details – in particular your full date of birth, address and contacts details – all of this information can be useful to fraudsters.

- Deactivate and delete old social media profiles – Keep track of your digital footprint. If a profile was created 10 years ago, there may be personal information currently available for a fraudster to use that you’re are not aware of or you have forgotten about.

- Password protect your devices– Keep passwords complex by picking three random words, such as roverducklemon and add or split them with symbols, numbers and capitals.

- Install anti-virus software on your laptop and personal devices and keep it up to date – This will make it harder for fraudsters to access your data in the first place.

- Take care on public Wi-Fi– Fraudsters can hack or mimic them. If you’re using one, avoid accessing sensitive apps, such as mobile banking.

- Think about your offline information too – Always redirect your post when you move home and make sure your letter or mailbox is secure.

If your bank is signed up and refuses to refund you, you can complain and ask it why it is not abiding by the code.

You may be able to report the case to the Financial Ombudsman Service, which reviews disputes between customers and financial firms. If it agrees with you your bank may have to pay you back.

If you’ve lost money or have been hacked as a result of responding to a suspicious text message, you need to report it.

Anyone living in England, Wales or Northern Ireland should contact www.actionfraud.police.uk or call 0300 123 2040.

For those living in Scotland, contact Police Scotland by calling 101.