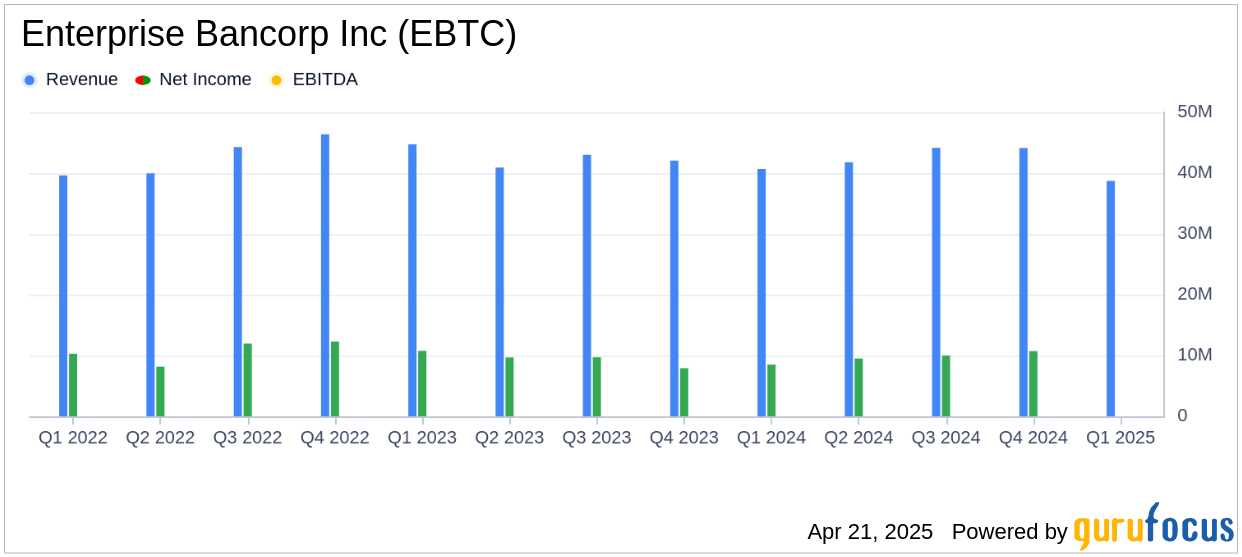

Enterprise Bancorp Inc (EBTC, Financial) released its 8-K filing on April 17, 2025, detailing its financial performance for the first quarter ended March 31, 2025. The company, a holding entity primarily engaged in deposit gathering and loan investment through Enterprise Bank, reported a net income of $10.4 million, or $0.84 per diluted share, slightly down from $10.7 million, or $0.86 per diluted share, in the previous quarter but up from $8.5 million, or $0.69 per diluted share, in the same period last year.

Company Overview and Strategic Moves

Enterprise Bancorp Inc, through its subsidiary Enterprise Bank, offers a wide range of financial services including commercial, residential, and consumer loans, deposit products, and wealth management services. The company is currently in the process of merging with Rockland Trust Company, a subsidiary of Independent Bank Corp, with the merger expected to finalize in the second half of 2025.

Financial Performance and Challenges

Enterprise Bancorp’s performance in the first quarter of 2025 reflects a stable financial position with a net interest margin of 3.32%, up from 3.29% in the previous quarter. The company experienced a 1.7% increase in total loans to $4.05 billion, although total customer deposits saw a slight decrease of 0.9% to $4.15 billion. Wealth assets under management also declined by 1.6% to $1.51 billion.

The company’s ability to maintain a strong net interest margin amidst fluctuating deposit levels and wealth management assets is crucial for sustaining profitability, especially in light of the upcoming merger which could introduce integration challenges.

Key Financial Achievements

Enterprise Bancorp’s net interest income rose by 10% to $38.7 million, driven by a $6.6 million increase in loan interest income. This growth underscores the company’s effective loan management and interest rate strategies, which are vital for banks to thrive in competitive markets.

Chief Executive Officer Steven Larochelle noted, “Loan growth was solid at 1.7% for the quarter and 11% for the last twelve months. Operating results compared to the prior year quarter were positively impacted by net interest income growth of 10% resulting from strong loan growth and an increase in net interest margin.”

Income Statement and Balance Sheet Insights

Enterprise Bancorp’s income statement highlights a decrease in non-interest income by 6% to $5.2 million, primarily due to reduced gains on equity securities. Non-interest expenses increased by 4% to $29.9 million, influenced by higher salaries and merger-related costs.

On the balance sheet, total assets grew by 2% to $4.90 billion, with investment securities at fair value increasing to $603.9 million. The company’s total shareholders’ equity rose by 7% to $385.4 million, reflecting a decrease in accumulated other comprehensive loss and an increase in retained earnings.

Credit Quality and Risk Management

The allowance for credit losses was stable at $64.0 million, representing 1.58% of total loans. Non-performing loans increased slightly to $28.5 million, or 0.70% of total loans, indicating a need for continued vigilance in credit risk management.

Executive Chairman & Founder George Duncan stated, “The planning for our integration into Rockland Trust is going well and the anticipated synergies and cultural alignment of our two banks remains attractive.”

Conclusion and Outlook

Enterprise Bancorp Inc’s first quarter results demonstrate resilience and strategic growth in key areas, despite challenges in deposit levels and wealth management assets. The upcoming merger with Rockland Trust presents both opportunities and challenges, with potential synergies expected to enhance the company’s market position. Investors will be keenly observing how the integration unfolds and its impact on future financial performance.

Explore the complete 8-K earnings release (here) from Enterprise Bancorp Inc for further details.