Also in the letter:

■ Google India head interview

■ ETtech Done Deals

■ Swiggy IPO’s fresh issue component hiked

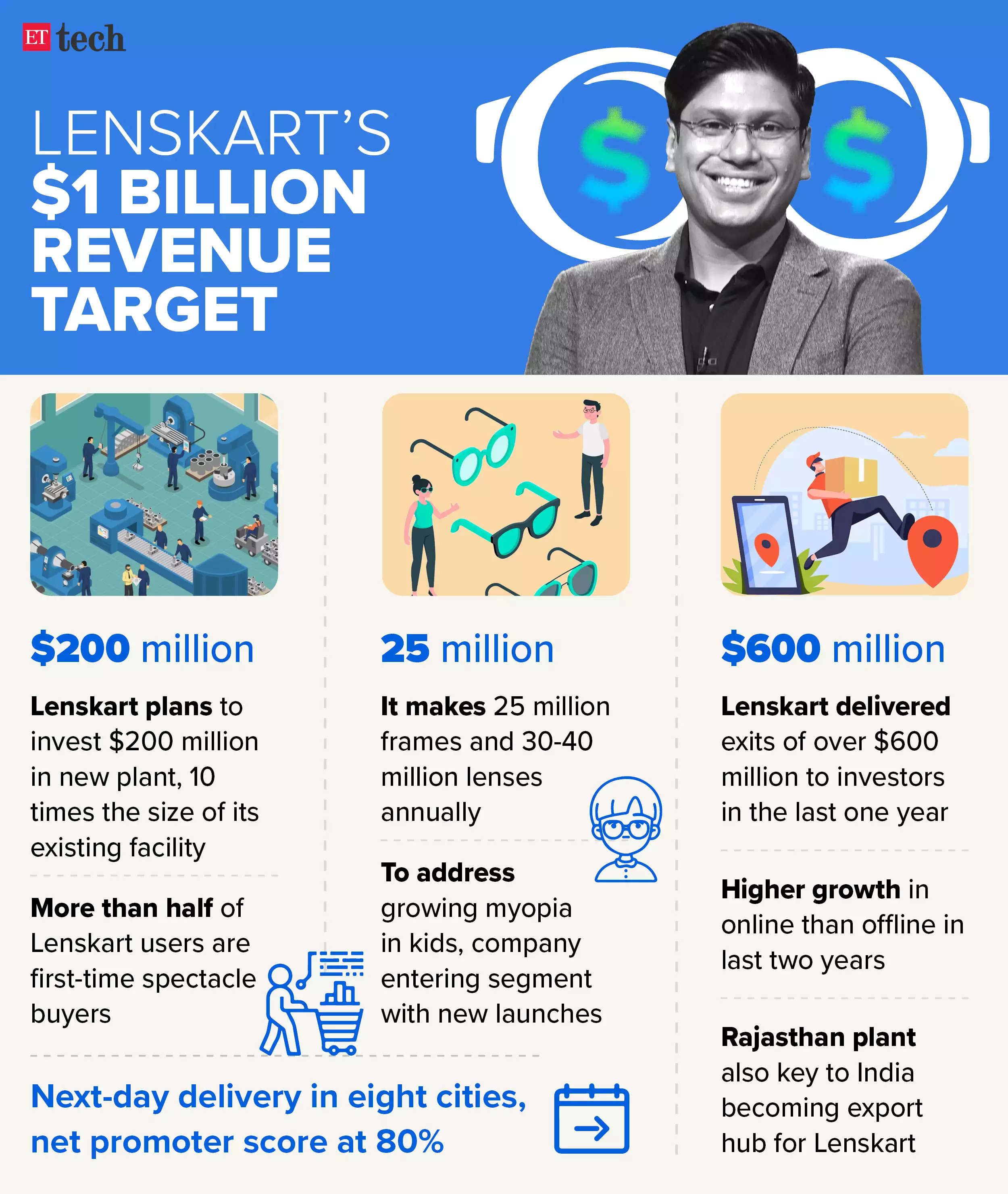

ET Startup Awards 2024: Lenskart eyes $200 million factory as revenue run rate hits $1 billion

Omnichannel eyewear brand Lenskart, which bagged the top honours at ET Startup Awards (ETSA) 2024, is witnessing stellar online growth backed by its boost to local manufacturing and resulting speedy delivery. “We’re just getting started,” chief executive Peyush Bansal told us.

Making in India: Lenskart is planning to establish a manufacturing plant in southern India, about ‘10X the size’ of its Rajasthan plant. Bansal said the company’s local manufacturing capabilities have helped drive not only domestic business but also sales in its global markets across Southeast Asia.

“The Rajasthan facility has been a pillar for us. We’ve moved a lot of our global manufacturing to India—frames that we used to import from Japan, we now make locally. This has allowed us to control quality, reduce costs, and improve delivery times significantly,” Bansal said. The new facility is expected to be operational in the next 18 months.

Omnichannel play: The jury at ETSA 2024 favoured Lenskart as the Startup of the Year for building a fast-growing, large-scale, omnichannel consumer retail venture. Bansal attributes a bulk of Lenskart’s expansion pace to its omnichannel strategy, with its online stores and 2,500 retail stores.

“Our online growth has been phenomenal, but what’s really driving it is our omnichannel presence. People buy online, but they also come to our stores for adjustments or to pick up their orders. The trust that we’ve built through our physical stores enhances the online experience,” Bansal said.

IPO plans: Bansal said Lenskart is in no rush to go public, adding that many companies are going public quickly because of exit pressures. “It will happen over time, but I still feel we are very early in our journey… We will go public when the company is at that stage—it doesn’t depend on market timing,” he said.

Also Read | ET Startup Awards 2024: Lenskart gets 10/10, bags top honours

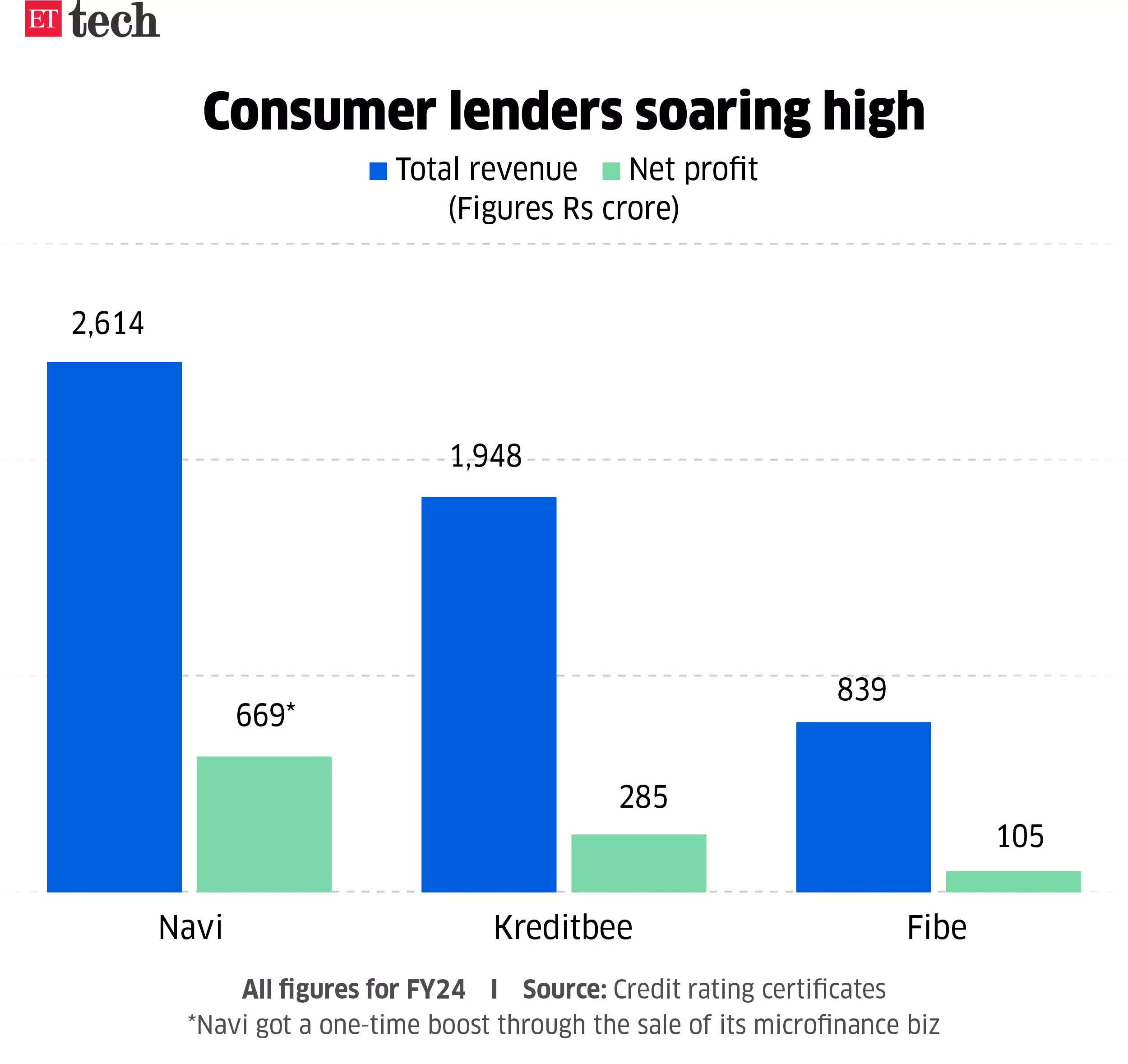

Consumer-lending fintechs steal show with surging numbers

Fintech firms in consumer lending such as Navi, Kreditbee, Moneyview, and Fibe reported strong profits and revenue growth in the last financial year, recovering from Covid-related challenges.

Strategy deep dive: Sachin Bansal-promoted Navi built assets under management (AUM) of Rs 10,190 crore just in the personal loan business by March 2024. It also reported strong financials with a net profit of Rs 669 crore.

Fibe built an AUM of Rs 4,064 crore as of March 2024 and reported a net profit of Rs 105 crore. Fibe’s technology-driven approach enables efficient loan portfolio growth with minimal manual intervention, monitoring asset quality through algorithms.

Moneyview’s FY24 net profit remained steady at Rs 171 crore, impacted by regulatory changes. Kreditbee, however, saw a sharp increase in profitability, with FY24 net profit tripling to Rs 285 crore, driven by growing market share.

Regulation implied slowdown: Fintech growth may slow down this year due to regulatory scrutiny, particularly the RBI’s caution on unsecured credit. Smaller fintechs may struggle to find co-lending partners, but larger startups are well-positioned due to past profits and momentum.

Consolidation is the new trend: The digital lending sector is poised for consolidation as scaling startups expand and acquire smaller players. Firms like FIbe, UGRO Capital, Flexiloans, and Axio are strengthening their positions through partnerships, acquisitions, and funding, and the trend is expected to continue.

Also Read | A new wave of fintech startups want to make fixed-income products attractive for consumers

AI is too important not to be regulated: new Google India MD

Roma Datta Chobey, MD, Google India

Google’s strategy in India will continue to be closely aligned with the country’s aspirations of becoming a developed nation in the next two decades, Roma Datta Chobey, Google’s new managing director for India, told ET.

Edited excerpts:

Objectives in place: “India’s vastness, complexity, and diversity is a huge opportunity, but it can also be a challenge. The focus is how do we make technology accessible, comprehensible, and even affordable?”

Why Gemini India? “Data residency has been a huge conversation recently, for rightful reasons, whether it’s healthcare, financial services, or others. It shows that India is a very important market for us, and we are solving in a focused way for India.”

AI regulations: “AI is too important not to be regulated, and not to be regulated well. It’s a very general-purpose technology that can be used for a vast range of use cases. At Google, we have our AI principles; we have our practices in place; we have a governance framework,” Roma Datta Chobey, managing director of Google India, said.

Also Read | GPay UPI circle, more languages in Gemini: key takeaways from ‘Google for India’

Google Play billing’s edge: “Google Play is playing an important role in making us an app-first nation. Indian developers are making Rs 4,000 crore through Google Play. What’s more interesting is that 84% of this is coming from exports,” she said.

New launches: The tenth edition of the ‘Google for India’ event on Thursday marked 20 years of the company’s operations in India. The tech giant announced new features for its chatbot Gemini and Google Pay, among others.

ETtech Done Deals

Shreyans Chopra, founder, Mstack

Mstack raises $40 million: Specialty chemicals startup Mstack has raised $40 million (about Rs 335 crore) in a funding round led by Lightspeed Venture Partners and Alpha Wave Global.

Str8bat raises Rs 29 crore: Sports technology startup Str8bat has raised $3.5 million (about Rs 29.3 crore) in a Series A funding round led by Exfinity Venture Partners.

Furnishka raises Rs 27 crore: Bengaluru-based furniture retailer Furnishka has raised Rs 27 crore in a pre-series A funding round led by India Quotient, bringing the total raised by the company to Rs 45 crore.

Other Top Stories By Our Reporters

Sriharsha Majety,CEO, Swiggy

Swiggy shareholders give nod to up IPO fresh issue component to Rs 5,000 crore: Shareholders of food and delivery platform Swiggy have cleared the company’s proposal to increase the fresh issue component of its upcoming initial public offering (IPO) to Rs 5,000 crore, people briefed on the development told ET.

Tata Electronics to partially resume work at fire-hit iPhone component plant: Tata Electronics said on Thursday it will restart some of its operations at the fire-hit plant in India’s south state of Tamil Nadu, which makes Apple iPhone components. A fire broke out in one of the six units at the plant in the early hours of Saturday.

UST acquires automation unit of ISG for $27 million: IT services firm UST said on Thursday that it has acquired the automation unit of Stamford-based Information Services Group (ISG) for a total consideration of $27 million (about Rs 226 crore).

Global Picks We Are Reading

■ Hacking Generative AI for fun and profit (Wired)

■ Google flexes its edge in India in AI showdown (TechCrunch)

■ OpenAI feels competitors breathing down its neck (FT)