Main Points

Best Reads

Some serious people are starting to get worried about the risks now appearing in the US financial markets, Cliff Taylor reports.

Larry Summers, a former treasury secretary who worked for the Trump and Obama administration, commented on X on the rise in US long-term interest rates. This is happening as investors sell off US bonds, or treasuries, which would normally be a safe haven in uncertain times but are now falling in price. When bonds fall in price, their yield, or interest rate goes up.

Summers wrote: “Long-term interest rates are gapping up, even as the stock market moves sharply downwards. This highly unusual pattern suggests a generalized aversion to US assets in global financial markets. We are being treated by global financial markets like a problematic emerging market.” In another post he suggested that the US could heading for a ” serious financial crisis.”

Market analysts are also now widely referring to this move out of US dollars. And there are reports of strains appearing in hedge funds, who are active traders in stocks and bonds, similar to what happened in 2000 in the early days of Covid.

Then, the US Federal Reserve, its central bank, had to engage in a massive rescue mission, pumping billions of dollars into the market. We also saw the Bank of England step in during the short-lived premiership of Liz Truss in 2022 to buy UK government bonds.

As treasuries are an asset which play a key role in global financial markets, there is not a trivial matter.

China raises 84% tariffs on US goods

China hiked its tariffs on US goods to 84 per cent from 34 per cent, in the latest escalation between the two countries. The increase is effective from April 10th, according to reports. It comes on the same day US tariffs of 104 per cent on Chinese goods came into force. China said on Tuesday to “fight to the end” against the US levies.

China told the World Trade Organisation (WTO) that Trump’s decision to impose what it has called reciprocal tariffs on Beijing threatens to further destabilise global trade.

“The situation has dangerously escalated…As one of the affected members, China expresses grave concern and firm opposition to this reckless move,” China said in a statement to the WTO on Wednesday that was sent to Reuters by the Chinese mission to the WTO.

US president Donald Trump’s “reciprocal” tariffs on dozens of countries took effect on Wednesday, including massive 104 per cent duties on Chinese goods, as the European Union prepared retaliatory measures, escalating a global trade war.

China told a WTO meeting on trade in goods that the reciprocal tariffs violated the organisation’s rules and undermined the multilateral trading system.

“Reciprocal tariff is not – and will never be – a cure for trade imbalances. Instead, they will backfire, harming the US itself.”

In the Dáil Labour’s Ged Nash said that “Trump’s trade tantrum is having a real world impact”, writes Maria O’Halloran.

He said the US president had “gambled away the world economy in service of his own ego” and it is “quite bizarre that the country that has done the most to design the current global world economic order is now set on destroying it”.

Mr Nash said this is not about economics. “This is a political project,” an ultra-nationalist political project” and Mr Trump would be presiding over the “ashes of a destroyed US economy” and all that entails for the world economy.

He said the Government must move in the weeks to come to put in some supports for businesses to help them ride out the storm in the short-to-medium term.

He reiterated his proposal for a temporary short-term work scheme that would keep workers tied to their employer and avoid redundancy.

Sinn Féin’s Pádraig Mac Lochlainn said the trade wars are heating up and there will not be any winners, “certainly not amongst workers and taxpayers”, writes Marie O’Halloran.

He said that the tariffs not directly levied on Ireland, on the EU “can still affect us through implications for supply chains” and “existing tariffs on other countries can bite here”.

Government must outline to people what it can do to protect their jobs and to offer them reassurance, he said.

“The only way to win a trade war is not to be in one,” he said. The Donegal TD said the party is very concerned that the EU will follow Trump’s approach and implement tariffs that are economically damaging. We are clear that the blame currently lies with Trump and that all options should remain on the table.”

Independent Ireland TD Ken O’Flynn accused the Government of “the same sluggish, slow, sloth-like reaction that we’ve seen time and time again from this Government, hoping the storm will pass rather than securing the roof”.

Speaking in the Dáil debate on the US tariffs he said “the reality is that our island is dangerously exposed. Our economy is built on export. Our ties in the United States are deep, our industries from pharma to tech and to cosmetics are directly in the firing line.”

He said the economy is “too fragile, and unbalanced, and this Government has tried for years and has done nothing to fix it. What have they done? We are still over reliant on foreign investment. Indigenous businesses are under pressure, over-regulated, over-red taped and overtaxed.

“Energy prices are crushing our competitiveness,” he said adding “infrastructure such as housing and transport is light years behind where it needs to be”.

The Cork North-Central TD said local businesses should be supported immediately, “not fix this in six months, not announce something for them in the budget. We must do it now.” He commended Minister for Enterprise Peter Burke for bringing in some emergency measures “but they don’t go far enough”.

‘Time to strike a deal’

Minister of State for European Affairs Thomas Byrne said that “every disagreement will end in agreement. This is our focus because there is time to strike a deal.”

He stressed that “the EU will respond in a proportionate manner which protects our businesses and our citizens, and we will take the necessary steps to safeguard our interests”.

The European Commission “has confirmed that it will seek the agreement of EU member states to impose rebalancing measures related to steel and aluminium tariffs this week and we expect that today, maybe as we’re speaking, and that decision would be taken.”

He told the Dáil that Ireland had spoken directly with the Commission about affected sectors resulting in bourbon and dairy products being excluded from tariffs, which would affect indigenous industry.

He said the commitment to dialogue and negotiation “also extends directly from the Irish Government to the US administration and in the Tánaiste’s meeting” with the US Secretary of Commerce.

Mr Byrne stressed Ireland’s links with the EU. The economy is “anchored in the European Union” and he said the country’s membership of the EU “has been a significant factor in our economic success over the last 50 years, We’ve gone from one million people employed at the time of joining the EU to six million at the moment”.

He said the tariffs “jeopardised global value chains, supply chains that have been carefully built over decades” and nobody is going to be exempt.

Noting the different tariffs between the UK and Ireland and the impact on the all-Ireland economy, he said “the Government is very conscious of this. and we are working through these issues at all times. There are no winners. US taxpayers would be losers as well, and they would feel the burden of higher costs”.

Mr Byrne said one of his “key jobs” at EU level is working to reduce red tape for business including SMEs. Ireland is fourth in the world in terms of competitiveness rights. There are difficulties “but we are very, very competitive”.

Financial market stress

Cliff Taylor: Are there signs of stress starting to appear in the financial markets? Equities are falling for sure as the growth outlook is revised down across the world and uncertainty rises.

However, as the tariffs come into effect and Donald Trump digs in, other warning signs are starting to flash.

In particular, US government bonds – or treasuries – faced a sell off overnight. This is the reverse of what usual happens when equities sell off – normally some of the money leaving equities would go into bonds as the latter are seen as a safe haven. And US treasuries are one of the ultimate safe havens – a massive $28 trillion market which is always liquid, in other words you can always buy and sell.

That is why today’s sell-off is notable. Are investors so nervous that they are moving into cash? Or are stressed investment funds having to sell all assets to raise cash to meet calls from financiers?

Or are Trump’s policies leading investors to move out of US assets completely ? The risk here is of problems emerging somewhere in the system – for example in a hedge fund – requiring the US central bank, the Federal Reserve, go step in. This is one to watch.

US tariffs will have an impact on the profitability of Irish companies

Minister for Finance Paschal Donohoe has warned that US tariffs will have an impact on the profitability of Irish companies exporting to the United States.

“It will now mean that Kerrygold is more expensive versus a competitor butter product that is developed within America,” he told Newstalk’s Pat Kenny show.

“It will then affect the profitability of the company that is selling that good into America. Because there tends to be great reluctance for the consumer to pay that higher tariff. Some manufacturers will say they’re willing to make less profit for a period of time. The reason why they would want to do that is to avoid the price of their goods going up in America and lead to them selling less. There are some signs at the moment that some sectors in the global economy are aiming to do that.”

“What you want to do then is apply tariffs to goods that are coming into Europe that do the least harm to the European economy. That is why we are doing two things; firstly, we are applying tariffs to goods that are coming in for which there may well be European substitutes available.

“Secondly, by going on particular parts of the economy, as opposed to a global response and applying tariffs to everything, we’re trying to avoid the kind of escalatory dynamic that we’re seeing happening elsewhere. We want to deliver this outcome via negotiation as opposed to a permanent trade war.”

New dynamic in the geopolitical order

Dublin MEP Barry Andrews has said there is a new dynamic in the geopolitical order and there was potential for a change in the relationship between the EU and China, writes Vivienne Clark.

Speaking on RTÉ radio’s Today with Claire Byrne show, Mr Andrews pointed out that trade agreements had been suspended because of concerns about human rights abuses in China and also sanctions that were placed on individual MEPs by the Chinese Government.

“I assume that there is some loosening of those tensions that existed between the EU and China, but there certainly is potential for some changes. But I think the European Parliament, which has the right to approve or not any trade that is arrived at by the commission would be very nervous about the shape of any even sectoral agreements with China but clearly Šefčovič was in Beijing for a reason and it would appear to be that things are improving between the EU and China.”

“The EU cannot out bravado Donald Trump,” the Dáil has been told in the first of two debates today on the US tariffs, writes Marie O’Halloran

Opening the Independent group’s private member’s motion Aontú leader Peadar Tóibín said the US president “is unencumbered by political pressure. He is unencumbered by international convention. The idea that we can somehow out bravado him in relation to this, given that he has launched 104 per cent tariff on China is absolutely wrong. I actually believe that the best retaliation is no retaliation, at the moment.”

The motion calls on the Government to take stronger and more direct role in negotiating with the US administration, to “demand that the EU pursues a pragmatic policy of de-escalation; and to “ensure that the EU does not make retaliatory tariff decisions that makes a target for the US of key Irish enterprise sectors”.

Mr Tóibín said today “is a dark day in terms of world history. It is a dark day, definitely, in terms of the Irish economy.”

“The Irish economy as it’s currently structured is significantly integrated into the US economy, and Ireland is in real danger, in serious trouble if this escalates.

“Escalation is the enemy of the Irish economy in terms of the trade war and with the United States.”

ECB ‘mobilised’ to ensure financial stability

The European Central Bank (ECB) is “fully mobilised” to ensure financial stability in the euro zone during times of “market stress”, the governor of the French central bank said on Wednesday, as global markets were roiled again by fresh turbulence. In a letter to French president Emmanuel Macron on Wednesday, ECB policymaker and governor of the Bank of France Francois Villeroy said Frankfurt is “fully mobilised to ensure the economy is well financed and (ensure) financial stability”.

He said the ECB and the Bank of France are “are monitoring to make sure the financial system’s liquidity is good, including in times of market stress”. Mr Villeroy also told reporters that Mr Trump’s tariffs announcement boosts the case for cutting euro area interest rates again when the ECB’s governing council meets later this month.

Faster-than-expected fall in ECB interest rates expected

In the every cloud and silver lining department, investment analysts now expect that the hit from a global trade war on EU growth will lead to a faster-than- expected fall in ECB interest rates this year, writes Cliff Taylor.

The ECB governing council is due to meet next week and another quarter point interest rates cut now seems nailed on.

Another may well follow at the next policy meeting in early June – and as of now markets are pricing in a further two over the balance of the year.

The ECB’s deposit rate is now 2.5 per cent and so could fall well below 2 per cent in the months ahead, bringing it back towards Covid lows, providing a boost to tracker holders and also leading to a general fall in market rates.

The flip side is the risk that tariffs imposed by the EU push up prices, which would be a problem for the ECB.

For now, however, with inflation falling towards the 2 per cent target and threats everywhere to growth the only way is down for interest rates.

EU counter tariffs

Officials from the EU’s 27 states are this afternoon due to approve its package of counter-tariffs hitting back against the United States, reports Europe Correspondent Jack Power.

The measures will put import duties of up to 25 per cent on a range of US goods sold to the EU, such as soybeans, steel, oranges, clothes, and washing machines. The retaliatory tariffs are designed to impact industries based in Republican states, to put political pressure on Donald Trump.

Trade officials representing each EU state are meeting in Brussels to approve the package of counter tariffs. The meeting is set to kick off at 1.30pm. The tariff measures are almost certainly expected to be approved.

The levies will then start to kick in from the middle of next week. Although import duties on some of the US products will only start being collected from May 15th. The EU’s tariffs on soybeans and almonds will be the last to take effect, coming into force in December.

US bonds under strain

Both the US dollar and the country’s Government bonds – two tentpoles of the global financial system – came under strain on Wednesday, writes Ian Curran.

Over the past four days, the yield on the benchmark US ten-year bond has experienced one of its most aggressive increases in such a short time frame in a quarter of a century, indicating that investors view the country’s debt as increasingly risky.

The US dollar fell against safe-haven currencies as investors fled to safe-haven assets like the Japanese yen, Swiss franc and gold.

Few assets were spared the recession fears engulfing markets, with oil prices tumbling by as much as 4 per cent.

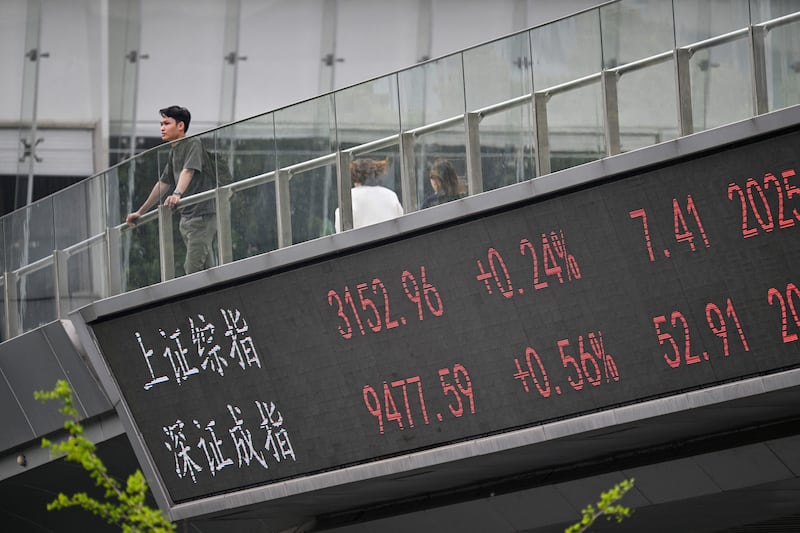

Meanwhile, China’s blue chip stocks reversed earlier losses to rise almost 1 per cent, likely underpinned by continued support from Beijing. Hong Kong’s Hang Seng index also reversed earlier declines to edge higher by 0.6 per cent.

Irish companies urged to map their supply chains

The interim chief executive of Enterprise Ireland, Kevin Sherry is urging Irish companies that export to the US to contact the dedicated response team to avail of supports. Speaking on RTÉ radio’s Morning Ireland, Mr Sherry said that companies were looking for up-to-date information and wanted to know what specific actions they can take. They also wanted to understand the tariffs and how they were going to apply to them and what supports are available. “So for Enterprise Ireland, we’ve established a dedicated response team. We’ve been in contact with all of those companies, providing them with up-to-date information and advice, information on the supports that they can avail of, and the actions that very importantly that they take, so the things that are in their control that they can take to respond to the current situation.

“If you’re an engineering company and you’re exporting into the US, from today your product will be subject to a 20 per cent tariff. Actually, it’s a little bit more complicated than that because, if you’re that engineering company and you’re also sourcing steel or aluminium from the US, the steel and aluminium that you’re sourcing from the US will be subject to a tariff of 25 per cent. So it’s really important for companies, one of the pieces of advice that we’re giving them is that they really understand their own supply chain and map their supply chain and understand what implications this has for their products.”

“At the moment one of the things we’re saying to companies is they really need to engage and proactively engage and talk to their customers and distributors and that is a topic of conversation about pricing.”

European share prices sank, oil prices plunged, and US Government debt sold off as Donald Trump’s 104 per cent tariffs on Chinese imports into the US took effect on Wednesday morning, sparking a wave of selling across global markets.

The Iseq index dropped by more than 2 per cent, erasing around half of Tuesday’s 4 per cent gain.

Europe’s big stock indices also opened lower, with the pan-European Stoxx 600 opening 2.4 per cent lower while the UK’s benchmark FTSE 100 index fell by more than 2 per cent.

The US dollar fell against safe-haven currencies, but the Chinese yuan hovered just above the lowest level since late 2007 as Beijing allowed the currency to depreciate further amid the sharp escalation in the trade war with the US.

US president Donald Trump has issued a fresh warning that the US will soon announce a “big” tariff on pharmaceutical imports.

His comments at an event at the National Republican Congressional Committee on Wednesday morning come as the global US tariffs kick in, including a 104 per cent tariff on China, the world’s largest exporter.

The Irish Government is expected to vote on a package of reciprocal European Union tariffs on US goods in a vote in Brussels today.

In a speech on Wednesday, Trump said a tariff on pharmaceutical companies – which would affect tens of billions of euros of Irish exports – will incentivise drug companies to move their operations to the US.

“We are going to be announcing very shortly a big tariff on pharmaceuticals,” Mr Trump said at the fundraising gala for House Republicans, without providing details on the planned levy.

“Once we do that, they’re going to come rushing back into our country, because we’re the big market,” he said. “The advantage we have over everybody is that we’re the big market.”

Trump has long bemoaned a lack of domestic pharmaceutical production and has repeatedly promised tariffs to bring more capacity into the country.

His administration has signalled that they’ll use so-called section 232 powers to enact the levies, though they haven’t launched the prerequisite investigation.

EU hits back

The European Union (EU) is to hit back at the United States with its own tariffs, targeting a range of goods from US soybeans, to steel, oranges, chainsaws and washing machines.

The EU plans to charge import duties of up to 25 per cent on a number of products sold from the US, in the bloc’s initial response to large tariffs on global trade introduced by US president Donald Trump.

The European Commission is now planning a further package of tariffs, beyond the measures EU states are due to vote to approve on Wednesday.

Trade mission to US

Meanwhile … Irish Times Washington correspondent Keith Duggan reports on the weeklong trade mission led by the Government to Washington.

Minister Martin Heydon met his American counterpart Brooke Rollins, the US secretary of agriculture, in Washington on Tuesday for what he described as a “really warm” engagement in which he sought to emphasise the depth of Ireland’s inward investment across the United States.

The meeting, at the US agriculture building on the National Mall, was the beginning of a weeklong trade mission led by Mr Heydon, and preceded the meeting of Tánaiste Simon Harris with the US secretary of commerce, Howard Lutnick, on Wednesday.

New deals

US agriculture secretary Brooke Rollins has said that new deals could be struck with other countries over trade tariffs by the end of this week.

Ms Rollins made the comments in an interview to Fox News host Bret Baier on the network’s “Special Report” show.

“I believe, sincerely, it will be sooner rather than later. I believe we’ll be hearing about new deals that are being struck, perhaps by the end of the week,” Rollins said, adding 70 countries had reached out to the US for talks.

Solution to the escalating trade crisis

Tánaiste Simon Harris will tell US commerce secretary Howard Lutnick in the US today Ireland and the EU are willing to find a solution to the escalating trade crisis, writes Keith Duggan.

Mr Harris has travelled to Washington, DC, for a meeting Donald Trump’s commerce secretary days after the US slapped “reciprocal” tariffs of 20 per cent on EU imports. It is the highest level meeting between the Irish and US governments since Mr Trump set out his aggressive protectionist policy a week ago in a move that has rattled global stock markets.

Mr Lutnick has repeatedly singled out Ireland and the Irish corporate tax regime as the “favourite” of what he calls “tax scams”, arguing that Ireland taxes US pharmaceutical and technology multinationals on their intellectual property (IP) rights at a low rate, at the expense of the United States.

Asian stock indexes sink

Big stock indexes sank in Asia on Wednesday after US president Donald Trump’s eye-watering 104 per cent tariffs on China took effect. A savage sell-off in US Government bonds sparked fears that foreign funds were fleeing US assets.

The US dollar fell against safe-haven currencies, but the onshore Chinese yuan hovered just above the lowest level since late 2007 as Beijing allowed the currency to depreciate further amid the sharp escalation in the trade war with the US.

Few assets were spared the recession fears engulfing markets, with oil prices diving almost 4 per cent. The pain is likely to spread to Europe too, with Stoxx 50 futures pointing to a 3.7 per cent drop upon open.